Understanding Liquidation Solutions for Business Success

In today's dynamic business landscape, companies often face challenges that lead them to consider various liquidation solutions. This article delves deep into what liquidation means for businesses, why it's a strategic option, and how to effectively implement these solutions to enhance profitability and product turnover.

What is Liquidation?

Liquidation is the process of winding up a business's financial affairs, which often involves selling off assets to pay creditors. While it is commonly perceived as a last resort for failing businesses, liquidation can also represent a strategic opportunity for profitable businesses to manage inventory and finances adeptly.

Types of Liquidation Solutions

Understanding the different types of liquidation solutions is crucial for businesses aiming to optimize their operations. Here are the primary forms:

- Asset Liquidation: Involves selling off physical assets such as inventory, equipment, and real estate.

- Inventory Liquidation: Disposing of excess or slow-moving inventory at discounted prices to recover capital.

- Business Liquidation: Complete closure of a business where all assets are sold off, usually in a structured manner.

- Online Liquidation: Utilizing e-commerce platforms to sell liquidated stock to a broader market.

The Importance of Liquidation Solutions

Implementing effective liquidation solutions has numerous benefits for businesses, including:

- Improved Cash Flow: Generating immediate cash from liquidated assets can help businesses meet short-term financial obligations.

- Reduction in Holding Costs: Minimizing the costs associated with storing unsold inventory or assets.

- Enhanced Inventory Management: Regularly liquidating slow-moving inventory ensures that your product offerings remain fresh and demand-driven.

- Brand Image Protection: Clearing out old stock can help maintain a positive brand image and avoid customer dissatisfaction.

How to Develop a Successful Liquidation Strategy

Creating an effective liquidation strategy requires careful planning and execution. Here are essential steps to consider:

1. Assess Your Inventory

Begin by conducting a comprehensive assessment of your existing inventory. Identify slow-moving items and surplus stock that can be liquidated. Use analytical tools to understand which products are not performing and contribute to financial strain.

2. Establish Clear Goals

Define what you hope to achieve through liquidation. Whether it’s generating cash flow, reducing storage costs, or clearing space for new products, having clear objectives will guide your strategy.

3. Choose Your Liquidation Method

Based on your goals and inventory assessment, select the most suitable liquidation method. Options include:

- Discounting: Offering products at reduced prices to incentivize purchases quickly.

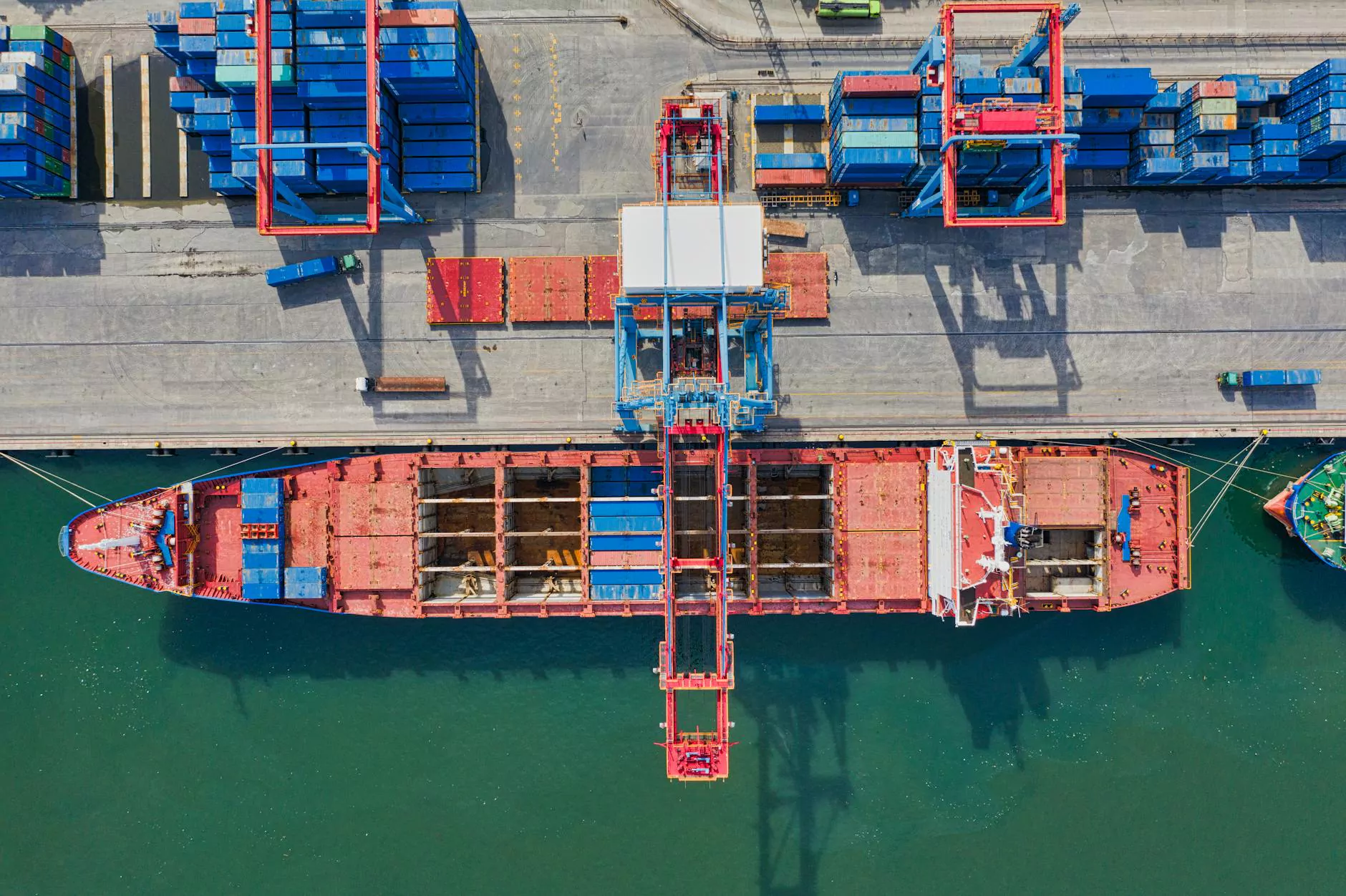

- Bulk Sales: Selling inventory in bulk to wholesalers or liquidation warehouses.

- Auctioning: Utilizing auction platforms to sell valuable assets to the highest bidder.

- Online Sales: Leveraging e-commerce to reach a wider audience.

4. Marketing Your Liquidation Sale

An effective marketing strategy is crucial for successful liquidation. Use email campaigns, social media announcements, and website banners to promote your liquidation sale. Highlighting the urgency and exclusive offers can help draw in customers.

5. Evaluate Your Results

After conducting a liquidation sale, take the time to evaluate the outcomes. Analyze sales data, customer feedback, and financial recovery to make informed decisions about future liquidation efforts.

Leveraging Technology in Liquidation Solutions

Incorporating technology into your liquidation strategy can enhance efficiency and reach. Some technological solutions include:

- Inventory Management Software: Tools that help track stock levels and identify liquidation opportunities.

- E-commerce Platforms: Online marketplaces can widen your audience and facilitate quicker sales.

- CRM Systems: Customer relationship management systems can help you communicate effectively with existing clients about liquidation sales.

Case Studies of Successful Liquidation Solutions

Examining real-life examples helps illuminate the effectiveness of liquidation strategies. Consider the following case studies:

Case Study 1: Retail Clothing Store

A retail clothing store faced oversaturation in inventory, leading to significant holding costs. By implementing a strategic liquidation sale, it managed to sell off 40% of its stock within a month at discounted prices. This not only improved cash flow but also made room for new seasonal items, positively impacting overall sales.

Case Study 2: Electronics Wholesaler

An electronics wholesaler found itself with outdated models due to rapid market changes. By partnering with an online liquidation platform, the business successfully auctioned off its inventory, recovering a substantial percentage of its initial investment while simultaneously clearing out its storage space.

Common Mistakes to Avoid in Liquidation

While liquidation can be a powerful tool, certain pitfalls should be avoided:

- Underpricing: Setting prices too low can lead to losses. Ensure that discounts are strategic and still cover costs.

- Lack of Marketing: Neglecting to promote liquidation efforts can result in low engagement. Make marketing a priority.

- Poor Inventory Assessment: Failing to accurately identify what to liquidate can hinder the overall effectiveness of your strategy.

- Ignoring Customer Feedback: Failing to take customer opinions into account can lead to repeated mistakes in inventory selection.

The Future of Liquidation Solutions

As the retail landscape continues to evolve, so too will the strategies around liquidation. Innovations in technology and shifts in consumer behavior will shape how businesses approach liquidation in the future. Here are some trends to watch:

- Sustainability: Companies will look to liquidate excess stock in environmentally friendly ways.

- Omni-channel Sales: Integration of various sales channels will become increasingly important in reaching diverse customers.

- Data Analytics: Enhanced data collection and analysis will drive smarter liquidation decisions.

Conclusion

Liquidation solutions can serve as a powerful mechanism for businesses to manage their assets, enhance cash flow, and streamline operations. By understanding the principles of effective liquidation, including assessment, planning, execution, and evaluation, companies can turn potential challenges into opportunities for growth. Embrace liquidation not as an end but as a critical component of your overall business strategy.

For wholesale businesses like those at TN International Wholesale GmbH, implementing a comprehensive liquidation solution can unlock unprecedented potential, ensuring inventory is managed efficiently and profits are maximized. In a world where agility and responsiveness are paramount, mastering liquidation is not just beneficial—it’s essential.